flow through entity private equity

Governor Whitmer signed HB. As a result only these individualsand not the entity itselfare taxed on the revenues.

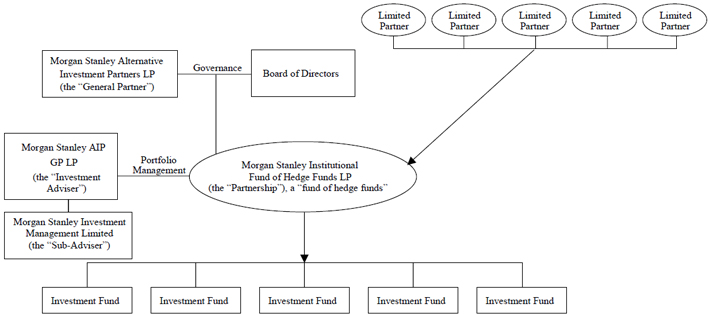

Morgan Stanley Institutional Fund Of Hedge Funds Lp

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. Flow-through entities are a common device used to avoid double taxation which happens wit See more. 99-6 where 100 of the interests in an entity taxed as a partnership are acquired the purchaser is treated as having acquired the assets of the entity in a taxable asset purchase2 This is the optimal result for tax purposes for the acquiror.

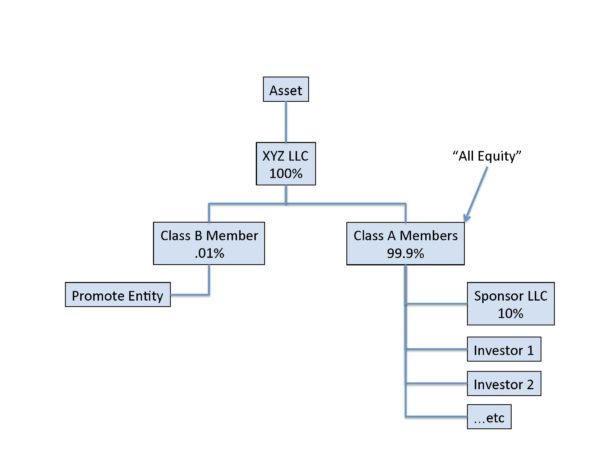

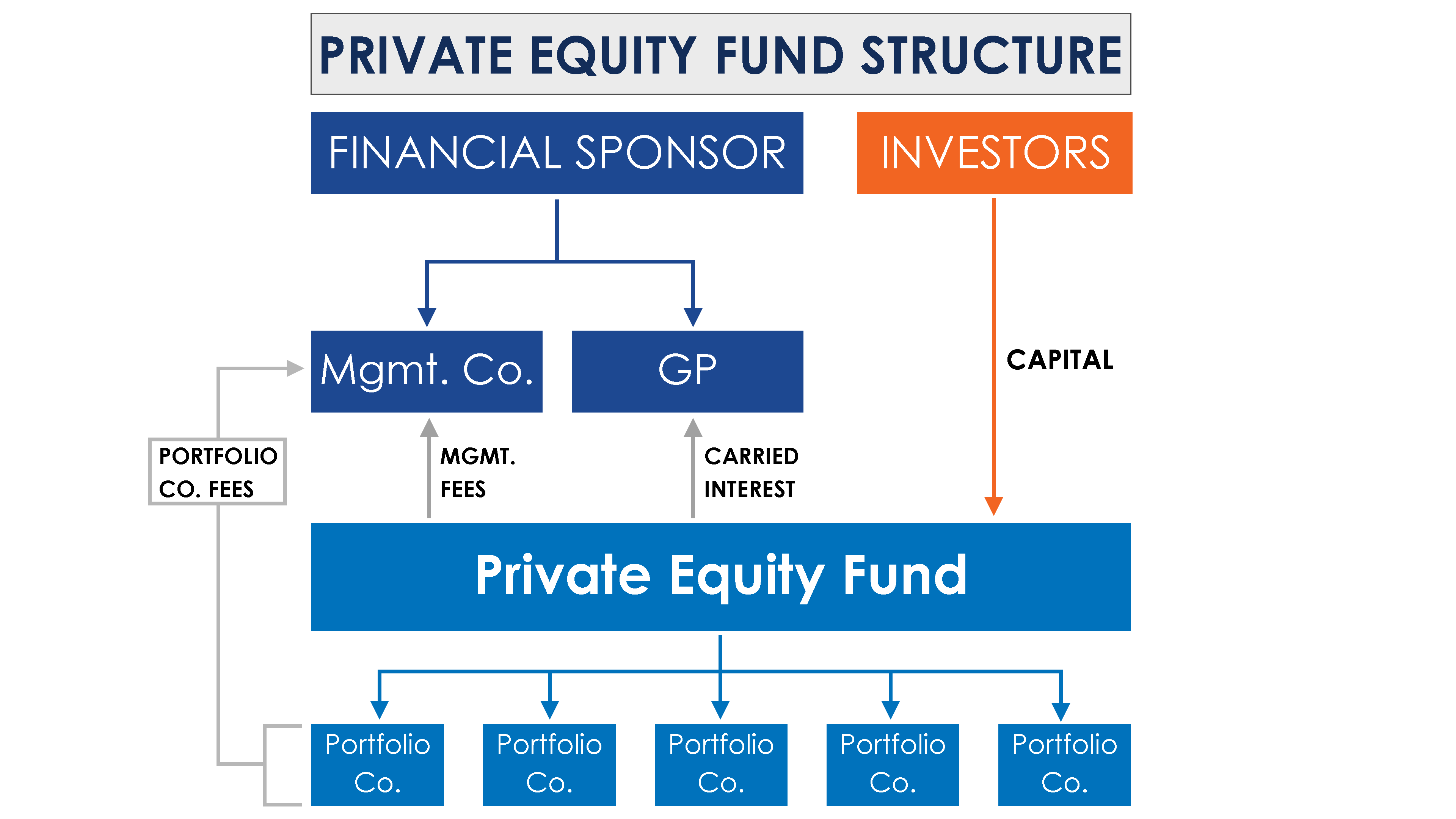

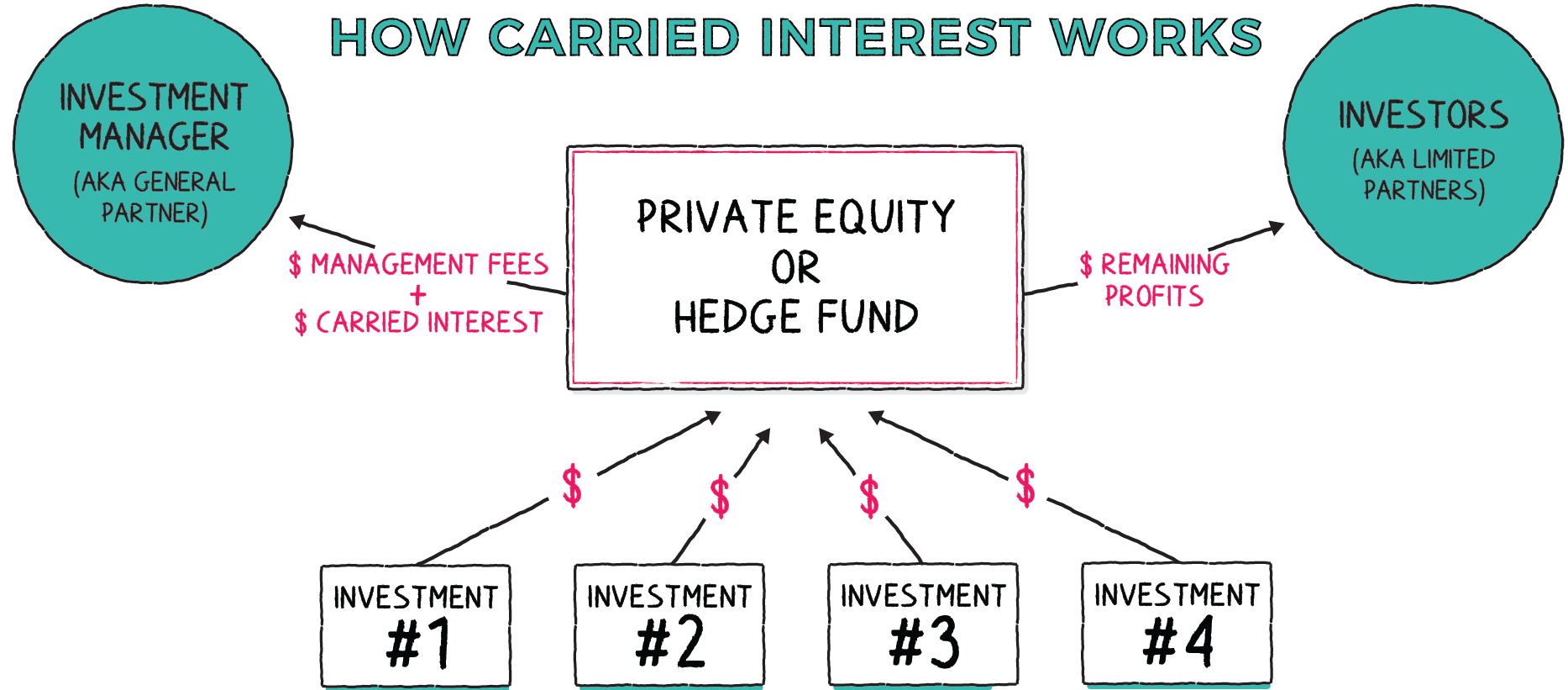

Advantages of a Flow-Through Entity. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. 1 Financial Sponsor Sponsor in image.

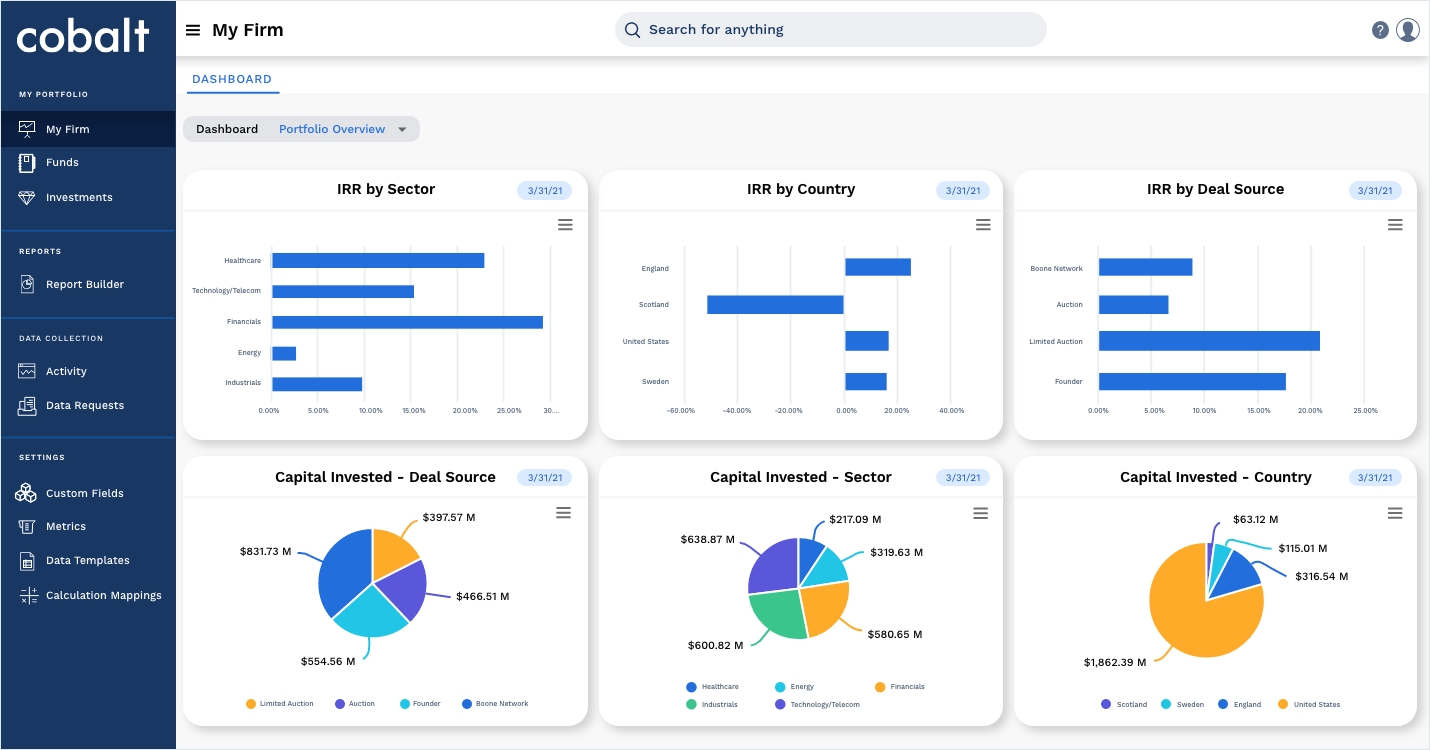

An entity is considered a flow-through entity if it is treated as tax transparent in the jurisdiction it was created which we understand to mean. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US. The cash flow structure for private equity funds has many implications for LPs.

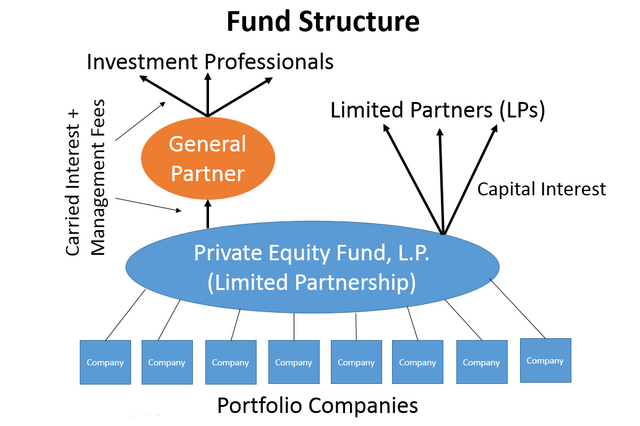

Raising a private equity fund requires two groups of people. While it can generally be. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on.

There are two major reasons why owners choose a flow-through entity. In addition the non-US. States real property interests USRPIs or interests in flow-through entities themselves engaged in a US.

It allows ownersshareholders to receive higher net returns on their investment. While it can generally be said the bulk of capital calls will occur during a funds investment period the actual timing and size of calls is unknown. The model rules refer to flow-through entities.

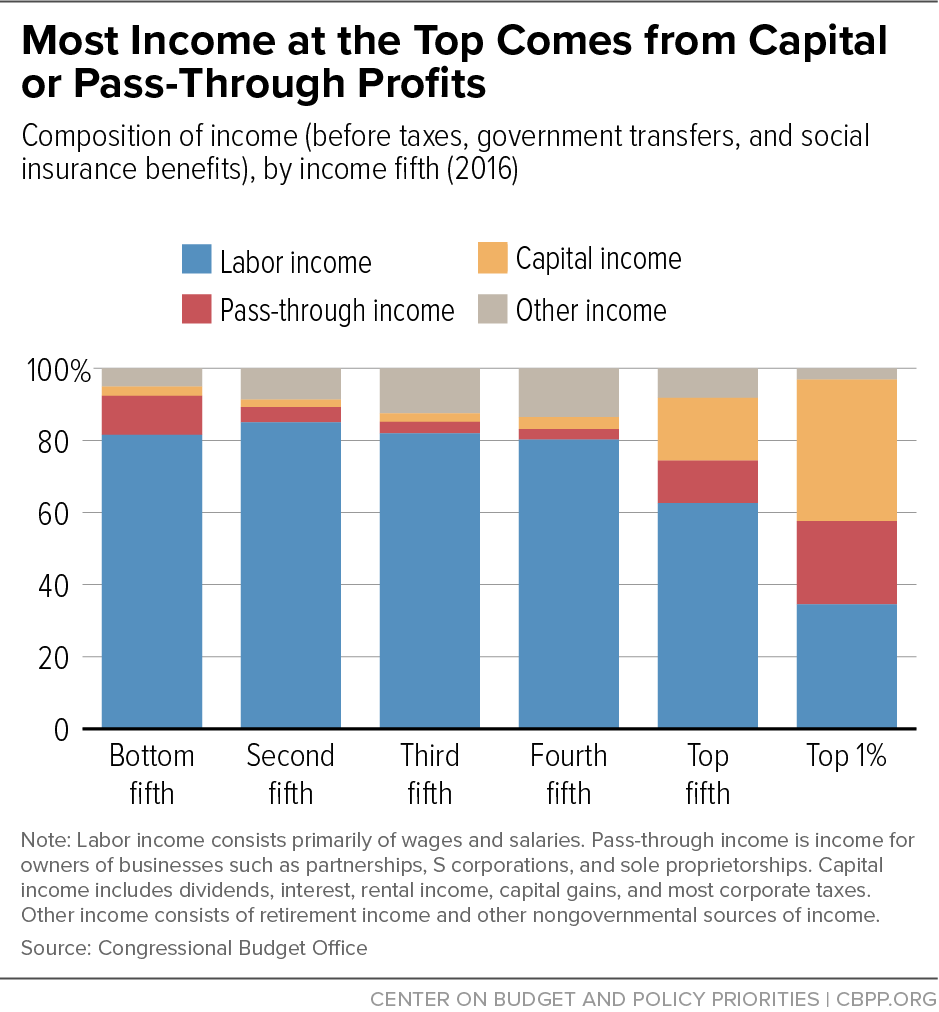

Impact of the 338h10 Election on a. The income of the owners of flow-through entities are taxed using the ordinary. Uncertain timing and size of distributions.

Some of the most active investors in private equity funds are. The entitys income only goes through a single layer of tax rather than two corporate tax and shareholder tax. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has frustrated many business owners since it was passed in 2017 as part of the Tax Cuts and Jobs Act.

Uncertain timing and size of capital calls. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests.

Trade or business flow-through operating entities. The income of the business entity is the same as the income of the owners or investors. Blocker corporation to hold an.

The team of individuals that will identify execute and manage investments in privately. A flow-through entity is also called a pass-through entity. Blocker corporation rather than a US.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

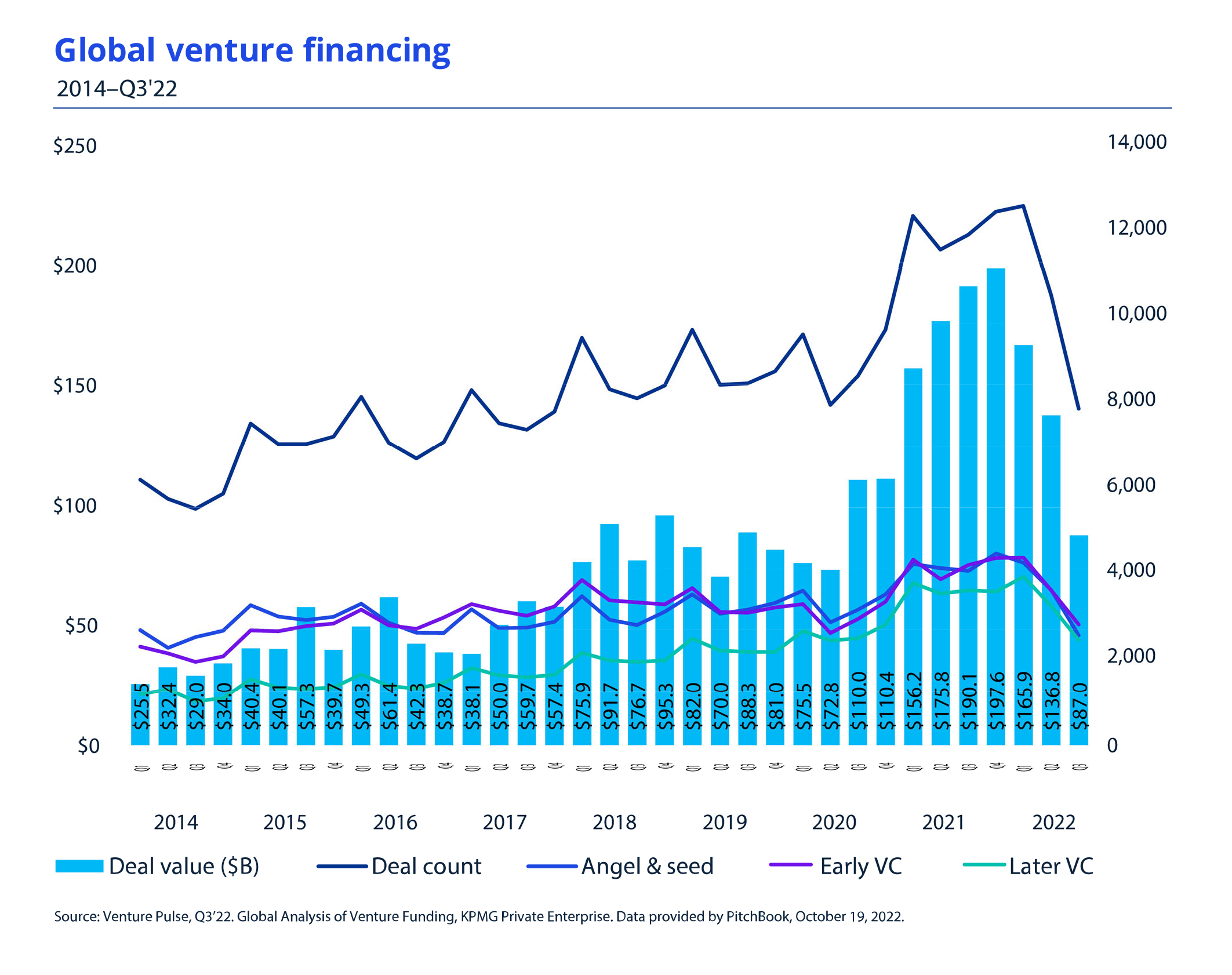

Top Considerations For Private Markets In 2022

Allen Latta S Blog On Private Equity Allen Latta S Thoughts On Private Equity Etc

Private Equity Fund Structure A Simple Model

An Introduction To The Use Of Blocker Corporations In M A Transactions Frost Brown Todd Full Service Law Firm

How Does Carried Interest Work Napkin Finance

Private Equity Vs Venture Capital What S The Difference Pitchbook

The Private Equity Market In 2021 The Allure Of Growth Bain Company

What Are Pass Through Businesses Tax Policy Center

Taxation Of Private Equity And Hedge Funds Wikipedia

In Plain English The Real Estate Private Equity Fund Profit Sharing Catch Up Mechanism Real Estate Financial Modeling

The New England Private Equity Venture Capital Advisor Pass Through Entities

Private Equity Venture Capital Factset

Publicly Traded Partnerships Tax Treatment Of Investors

How Private Equity Works A Brief Explainer Moonfare

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Several Macroeconomic And Geopolitical Factors Drop Vc Investment To Below 100 Billion In Q3 22 But Investment Flows To Priority Sectors Says Kpmg Private Enterprise S Venture Pulse Report Business Wire

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding